It had to happen.

A couple of weeks ago Facebook had a market capitalisation of close to $630 billion. Within two days it had fallen to $505 billion. A 20% fall is a big move for a company the size of Facebook.

However, it’s totally normal. And it’s really worth remembering how normal this sort of a fall is when you are investing in a company that has produced massive market-beating returns.

Michael Batnik points out in a recent post that even with this fall, Facebook is still up 500% over the past five years.

That’s huge.

You just don’t get those sort of returns without experiencing big and frequent drawdowns. It’s no easy feat becoming one of the biggest companies in the world. And it’s certainly not smooth sailing.

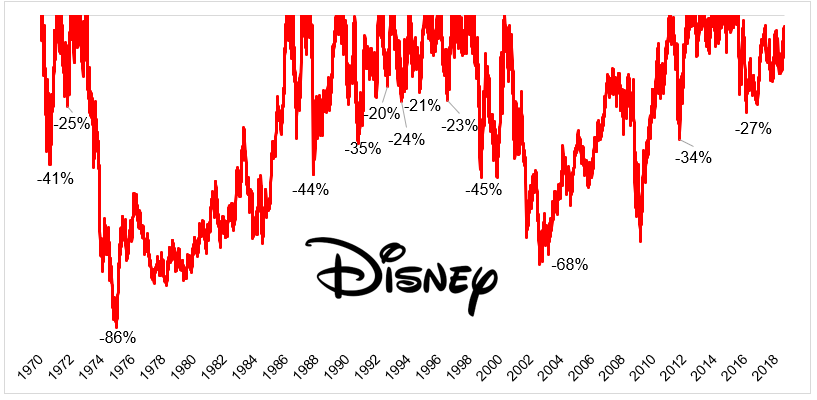

In his post Batnik looks at Disney, another mega-performer. If you have owned Disney since 1970, you have made around 19,500%. Extraordinary. But I can tell you this for sure. There are very few investors who have managed to hold on to Disney stock through all of the drawdowns (this chart shows the drawdown history of Disney, i.e. every loss from the previous peak):

To earn 19,500% you had to go through 7 falls of 30% or more, 3 of 40% or more, and 2 of 60% or more.

The story with Amazon is exactly the same. Since it’s IPO in 1997 it’s returned something like 38,000%. It’s easy to look back and say, wow, if only I had bought Amazon. But buying it is not enough. You have to buy and then hold through all the falls. And even if you put a relatively small amount of money in at the start, with those kind of returns, it gets big quickly. And then you have to watch a large portion of your wealth fall sharply. When these big falls happen, you are always left questioning whether the best days are behind you.

My point is, once again, don’t let anyone ever tell you that investing is easy. Earning these sorts of returns is really really really hard. The 35% a year return that Amazon has produced has not been achieved in a straight line. It has been achieved through a great deal of volatility. Volatility and return are inextricably linked. You just can’t get one without the other.

I think this is one of the most overlooked facts in investing. We (I mean us, in the industry) are so quick to talk about 10-12% returns, gained over the long-term. And in a way, I think we do a really big disservice to people to even cite these figures. Because 10% is the average of a series of extremes. The market goes up 10-12% very rarely. Average is not normal. What is far more normal is returns above 20% or negative returns.

Tactically, it’s quite easy to achieve the long-term market returns (buy and hold an index fund). But temperamentally, it’s really hard. And investing is half tactical (or intellectual) and half temperamental (or emotional).

So, if achieving market-like returns is hard, then like I said, achieving serious market-beating returns is really really really hard. My suggestion? Don’t try because the chances are it will end in tears.

georgie@libertywealth.ky