2025 In Review: It Has Always Worked

One of my favourite investing quotes is from Morgan Housel:

“Every past market crash looks like an opportunity, but every future crash looks like a risk.”

It sums up the psychology of investing so wonderfully.

Let’s just take a quick look at the last crash which started on 19th February 2025 and finished just 6 weeks later.

2025 had started well with the S&P 500 clocking a 4.5% gain by the 19th February. But, things quickly changed as the market got wind of Trump’s tariff plans. You will remember the infamous day, April 2nd. Trump stood in front of the world with cardboard cutout, some very dubious maths, and announced a series of ‘reciprocal tariffs’ on the world. (Not even the penguins were spared).

Markets were not happy and plummeted 21% in around 6 weeks, with the S&P 500 hitting a low of 4800.

Tariffs were due to start on April 9th. But they didn’t because it turns out, well, TACO.

Trump Always Chickens Out.

On the 9th April, the day he TACO’d, the S&P 500 rose 9.5%. That was its third biggest one-day gain since 1950.

Let me tell you….you don’t want to miss out on days like that.

TACO continued on throughout the first half of 2025 with the S&P 500 staging one of the most magnificent comebacks in history. The S&P 500 ended the year up 17%. A pretty solid year by all metrics.

The severity of the fall was matched by the strength of the recovery, as is so often the case.

And so we look back at an opportunity, just 9 months ago, to buy the 500 biggest and best American companies at a price of 4800. Today that will cost you just shy of 7000.

Every one of the 18 crashes that has happened since the end of the WWII was an opportunity to buy the great companies of the US and the world ON SALE. Yet we are so afraid of the next crash.

And yes a crash is coming. A crash is always coming.

But no one, NO ONE, knows when or what will cause it. We don’t need to know. We just need to know that it will end, like all the others. And we will look back and see what a wonderful golden opportunity that was to go bargain hunting.

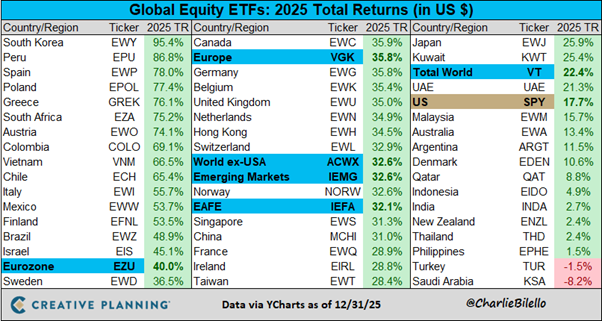

There was another story worth telling from 2025, and that was the story of the rest of the world.

World markets have been totally dominated by the S&P 500 for the last 15 years. In 2024 we saw the biggest outperformance of US stocks versus the rest of the world since 1997 and it took the US market to a level versus the rest of the world that we had never seen before.

At that point I was fending off a lot of questions from clients around, ‘why don’t we just put everything in the S&P 500?’ and ‘there doesn’t seem to be any benefit to owning the rest of the world.’

Sit tight, I said. (You can see my exact words in my newsletter written this time last year).

I hate to say ‘I was right’, but I was right. Diversification is always right.

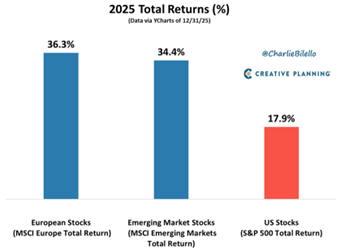

The rest of the world (Europe and Emerging Markets) are going gangbusters right now. They outperformed in 2025 and have continued on that streak into 2026.

And guess what I am hearing now?

“Georgie, do you think we should have less in the US?”

Here’s my answer to that question.

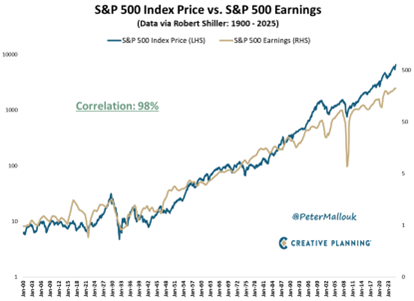

In the long-run stock prices are driven by corporate earnings. Share prices go up because earnings go up.

In 2025 the earning of the S&P 500 companies rose 13% to new record highs. Companies in the US are thriving, despite the almost unrecognizable nature of the current political landscape there.

In the long-run it has never paid to bet against the US economy or US companies. A globally diversified portfolio, including the US, has always been the right thing to own and today is no different. There is no reason to believe that the relentless uptrend of company earnings and therefore company share prices will not continue.

I mean, one day the world will end. That is true. But it will only happen once. We can’t make investment policy out of Armageddon.

Moving forward

As I write the S&P 500 sits at an all-time high. Many clients are struggling to reconcile this with the feeling that the world is falling apart.

As you know, we are not in the business of making predictions. Because as Lao Tzu said, “those who have knowledge don’t predict. Those who do predict don’t have knowledge.”

We believe that the economy cannot be consistently forecast, nor the markets consistently timed.

What do we do instead?

We:

· Heed Morgan Housel’s word that, “the most important events in history (and our lives) are the ones that no one saw coming”. Or as Daniel Kahneman said, “the thing to learn about surprises is that the world is surprising”.

· Prepare ourselves for surprises by building a financial plan that makes us antifragile – that is, able to not only withstand the surprises that come our way (redundancy, sickness, death) but to come out stronger.

· Build for survival not for perfection. We are long-term, goal-focused, plan driven investors.

· Fund a plan by investing in a broadly diversified portfolio of equities. We conclude that the only way to capture the full premium return of equities is to ride out their frequent, sometimes significant, but historically always temporary declines.

· Believe that long-term compounding of equities is the most important force guiding us toward the achievement of your goals. Our antifragility means that we are able to survive long enough to allow compounding to work its magic. Because as Charlie Munger said, the “first law of compounding is never to interrupt it unnecessarily”.

· We do not accept that “this time is different” regardless of what “this” may be at any given moment.

Nothing we do or say is based on anything other than the weighty evidence of history. We are following a plan that has always “worked”.

As a client of Liberty Wealth you have built and stewarded wealth over the past few years in the most efficient and exceptional way. We handed your hard-earned money to the great CEOs of the world and they compounded it for you, whilst you slept. We ignored the fears and fads of the day. We didn’t react to any of the one, two, three of four crashes you lived through. The very handsome gains you see on your statement are the result of, not our smarts, but your trust in us and the process.

Thank you for that trust. I never take it lightly.

Georgie

georgie@libertywealth.ky